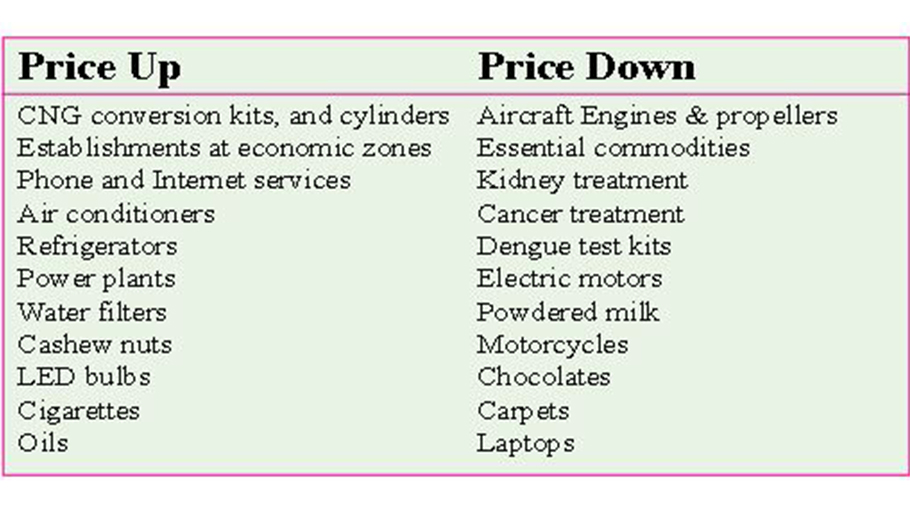

Prices up, down

As per the Tk 7,96,900 crore (approximately $7.97 billion) budget placed at the parliament on Thursday by Finance Minister Abul Hassan Mahmood Ali for the fiscal 2024–25, prices of different things are going to rise while others are going to be reduced.

In this year's budget, depending on the facilities given and withdrawn, prices of products may increase and decrease.

Prices may go up

Phone and Internet services: The proposed increase in supplementary duty may increase SMS and call rates and internet costs.

Oils: Prices of furnace oil, lubricants, mineral lubricants, and base oil are likely to increase.

Cigarettes: The price of all types of cigarettes is set to increase. A 60 to 65.5 percent supplementary duty hike on various categories of cigarettes has been proposed.

CNG conversion kits, and cylinders: Import duty is proposed to increase from 3 percent to 5 percent on these goods. So, the expenditure may grow in this sector.

Power plants: Import duty on equipment and materials for the Rampal power plant as well as various power generating stations has been increased from 0 percent to 5 percent. Establishments at economic zones: It has been proposed to levy a 1 percent customs duty instead of a subsidised facility (duty-free) on the import of capital machinery and construction materials in economic zones.

Air conditioners and refrigerators: Import duties on compressors and steel sheets used in AC production as well as raw materials for refrigerators have been proposed to increase. As a result, the price of air conditioners and refrigerators may increase.

Water filters: the price of household water filters may increase as the import duty on these has been proposed to increase from 10 percent to 15 percent to promote the local manufacturers.

LED bulbs: A proposed 10 percent import duty on energy-saving bulb manufacturing materials may raise the price of LED bulbs.

Cashew nuts: A 5 percent to 10 percent import duty on shelled cashew nuts has been proposed as part of safeguarding the domestic industry. So, the price of these delicacies may increase.

Other products: Prices may also increase for products such as ice cream, carbonated beverages, amusement parks, theme parks, and tourism services as the ministry also proposes VAT on these sectors.

Price May Go Down

Essential commodities: The import duty of 30 essential commodities including rice, edible oil, sugar, chickpeas, milk and wheat has been proposed to be reduced.

Aircraft Engines & propellers: VAT withdrawal on imports of aircraft engines and propellers has been proposed considering the prospect of the aviation sector.

Powdered milk: A 20 percent supplementary duty on the import of packaged powdered milk has been withdrawn. This may reduce the price of imported powdered milk.

Chocolates: Supplementary duty on the import of chocolate has been reduced from 45 percent to 20 percent. So, the price of chocolate, which is preferred by all age groups, may decrease.

Laptops: VAT has been withdrawn on the import of laptops to stop the import of used laptops. Import duty has been reduced to about 20.50 percent from 31 percent.

Motorcycles: Import duty on engine parts has been reduced which may bring down the price of motorcycles made in the country.

Dengue test kits: Exemptions of import duty, value-added tax, and advance tax on rapid dengue detection test kits, dengue re-agents, and platelet and plasma test kits for dengue treatment have been proposed.

Kidney treatment: The import duty on dialysis filters and dialysis circuit products, the most popular tools for treating kidney patients, has been reduced from 10 percent to 1 percent.

Cancer treatment: Import duty waiver on some equipment used in the treatment of cancer has been proposed.

Carpets: Import duty on polypropylene yarn, the main raw material for making carpets, has been reduced from 10 percent to 5 percent.

Electric motors: A subsidy has been proposed to increase the import of parts used in the production of electric motors.

Methanol: Methanol is one of the raw materials of industries such as medicine, washing plants, paint etc. The import duty rate has been reduced from 10 percent to 5 percent if this product is imported in bulk.