Policy support vital to implement ‘Smart Bangladesh’

Speakers say at post-budget discussion

Country's ICT sector business leaders hailed the government's decision for extending the tax exemption period of the ICT sector by three years in the budget of the FY 2024-25 announced by the government. Besides, they said policy support is needed now to achieve self-reliance in this sector.

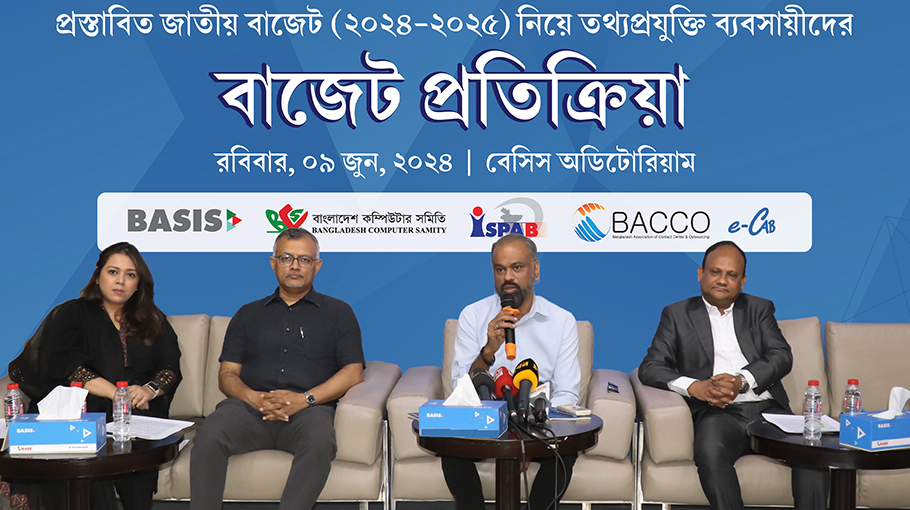

The Bangladesh Association of Software and Information Services (BASIS), Bangladesh Association of Contact Center & Outsourcing (BACCO), Internet Service Provider Association of Bangladesh (ISPAB) and E-Commerce Association of Bangladesh (E-CAB) have jointly organized the press conference at BASIS Auditorium in Dhaka.

BASIS President Russell T. Ahmed, BACCO President Wahid Sharif, ISPAB President Md Emdadul Hoque and E-CAB Vice President Syeda Ambareen Rezawere present at the press conference and gave their budget reaction on behalf of their respective associations and answered various budget related questions from the media representatives.

At the conference, BASIS President Russell T. Ahmed thanked Prime Minister Sheikh Hasina for extending the tax exemption for the ICT sector by three years.

He stated, "This tax exemption will not only contribute to the development of the ICT sector but also play a crucial role in building Smart Bangladesh, impacting various fields such as education, healthcare, agriculture, banking, and export-oriented manufacturing."

BASIS President also pointed out that currently, only 10% of the $20 million cloud service and web hosting market is held by local entrepreneurs. He warned that bringing these services under taxation could discourage domestic entrepreneurs.

He emphasized the need to keep cloud services and web hosting tax-exempt to support the growth of local ICT and service companies.

BACCO President Wahid Sharif highlighted that the tax exemption in the ICT sector would significantly contribute to technological advancement, innovation, and the creation of new entrepreneurs.

ISPAB President Md Emdadul Hoque expressed concerns regarding the proposed budget for the fiscal year 2024-25. Despite directives from the Prime Minister to enhance the ICT service sector, the failure to include all ISP services under the IT-enabled services (ITES) category, coupled with a 10% advance income tax (AIT) on broadband internet service providers and a 37% VAT and duty on ONU and OLT equipment, poses significant challenges.