Good governance key to address banking sector challenges

Experts at BUILD FSDWC meeting

Deputy Governor, Bangladesh Bank Abu Farah Md. Nasser said that the key focus of central bank is to take proper, visible and fast actions to ensure good governance in the banking sector for addressing monumental challenges faced by the banking sectors due to control inflation and volatility in the foreign exchange regime and higher non-performing loans.

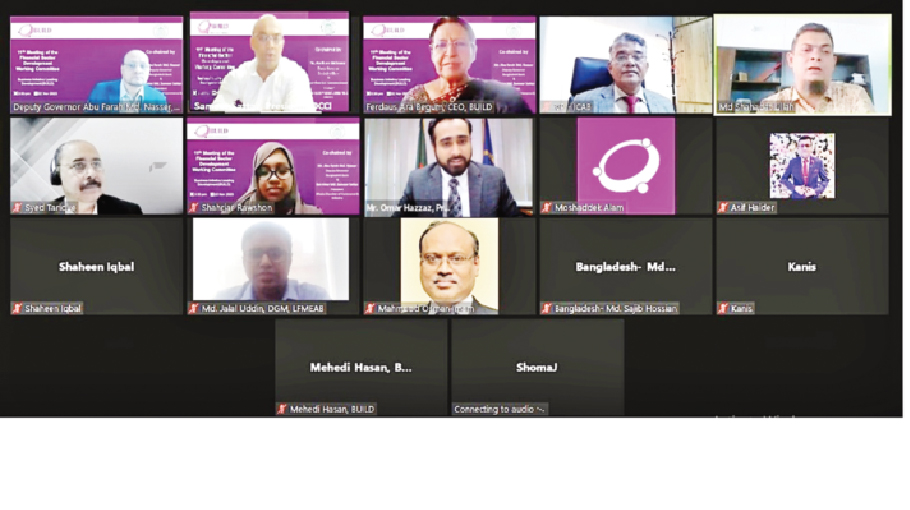

The Deputy Governor was speaking at the 11thFinancial Sector Development Working Committee (FSDWC) Meetingorganized virtually by Business Initiative Leading Development (BUILD) on November 22.

Abu Farah Md. Nasser, Deputy Governor, Bangladesh Bank (BB), and Barrister Sameer Sattar, President of Dhaka Chamber of Commerce, and Industry (DCCI) co-chaired the meeting.

He further said that the present situation of investment and trade will get momentum after the upcoming election and new administration will boost the confidence of the investors. From Bangladesh Bank, we have adopted a single exchange rate policy despite, it is fixed by the ABB and BAFEDA, we are strictly monitoring the rate. To manage the exchange rate fluctuation, the Bangladesh Bank are in contact with the Reserve Bank of India.

DCCI President stressed the importance of managing and controlling non-performing loans through the implementation of governance practiced by scheduled banks.

He further advocated for the development of a swift recovery plan with the stakeholders recovering default loans to revitalize the financial sector. Additionally, he expressed gratitude to Bangladesh Bank for streamlining the loan sanction process and minimizing approval times, thereby facilitating easier access to financing for businesses.

Having updated the implementation on the last 10th FSDWC Meeting, BUILD CEO Ferdaus Ara Begum delivered a first presentation on Export Facilitation Pre-Financing Facility(EFPF)highlighting a comparative scenario of EDF and EFPF, constraints faced by the exporters in case of enjoying EFPF etc.

The policy paper recommended for increasing the celling of EFPF based on the present demand of the sectors up to, Tk 30,000 crore(USD 2.75 billion) with proper monitoring of BB from which loans will be given to pay back-to-back LC payments.

The working committee meeting was participated by the members of the committee, representatives of the central bank, ABB, BKMEA, LFMEAB a number of scheduled banks, academicians, business chambers and associations, entrepreneurs from the private sector etc.