Global climate group asks investors to ‘make good’ on net zero pledges

It's time for financial institutions to "make good on their commitments" to eliminate carbon emissions from their portfolios, according to the finance industry's biggest climate coalition.

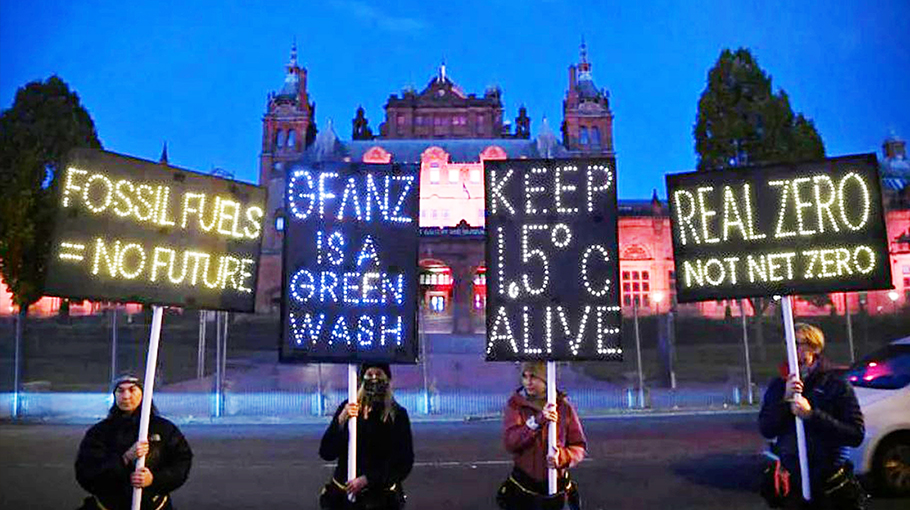

The Glasgow Financial Alliance for Net Zero (GFANZ), which includes insurers, banks and asset managers overseeing a combined US$130 trillion (S$181 trillion) of assets, published a series of documents on Wednesday (June 15) it says provides a template for how finance firms can enable the global economy to pivot from fossil fuels to clean energy.

The centrepiece of its efforts is a proposal for what credible net-zero transition plans for finance firms should look like.

The plan would require banks to detail the actions they will take, the metrics by which their progress should be judged and evidence that their decisions are aligned with the ultimate objective of limiting global warming to 1.5 degrees Celsius.

Mobilising the finance sector to get behind efforts to lower greenhouse gas emissions is central to the mission of GFANZ, which was set up last year by former Bank of England Governor Mark Carney.

The banking industry has been widely criticised for helping oil, gas and coal companies raise more than US$4.5 trillion since the Paris climate agreement was announced at the end of 2015.

Forcing banks to explain how they will support the energy transition, as well as how they will navigate issues such as so-called stranded assets, will help show who's really following through on their pledges and who isn't.

The proposals are designed "to ensure that financial institutions make good on their commitments in a credible, transparent manner, in line with the need to accelerate action that has been identified by climate scientists", said GFANZ vice chair Mary Schapiro, who's also vice chair for global public policy at Bloomberg LP, the parent of Bloomberg News.

GFANZ's transition plan recommendations, which were set forth in a public consultation document, are designed to force companies to translate their net-zero commitments into "a coherent strategy with specific objectives and actions aimed at reducing real economy greenhouse gas emissions".

The plan also should be in keeping with what scientists say is needed to limiting warming to 1.5 degrees "with low or no overshoot"

Having a transition plan "allows for accountability and signals to both internal and external audiences that an institution's steps toward net zero are deliberate, transparent and have high integrity", GFANZ said.

Credible plans will provide funding for so-called climate solutions such as renewable energy; support companies that are already aligned with a 1.5 degrees future, as well as those that aren't, including those from high-emitting sectors; and help facilitate or finance the "managed phaseout of high-emitting physical assets" such as coal plants.

The GFANZ document noted the potential for greenwashing of business-as-usual financing activities. "Without clearer guardrails in place that enable transparency and accountability, financing for high-emitting companies and assets should be vigorously scrutinised to ensure net-zero alignment," it says.

Convened by the United Nations, GFANZ comprises seven groups spanning all corners of the financial industry. These include the Net-Zero Asset Owner Alliance and Net-Zero Banking Alliance. Signatories must commit to use science-based guidelines to document their path toward net-zero carbon emissions, and to provide 2030 interim goals.

Michael Bloomberg, the owner and founder of Bloomberg LP, has been co-chair of GFANZ with Carney since November 2021. GFANZ also published guidance on Wednesday on how to deal with assets that become uneconomic to operate, or "stranded", when the world moves away from fossil fuels.

A "managed phaseout" of high-carbon assets is an alternative to divestment, which can actually result in prolonging the life of high-emitting assets by passing them on to less climate-conscious owners, the group said. This isn't just an issue for oil majors and miners, but also for the aviation, utilities and shipping industries. Separately, the United Nations-backed "Race to Zero" campaign, which sets the guidelines that underpin the GFANZ alliances, updated its criteria on Wednesday that would require banks and investors to "restrict the development, financing and facilitation of new fossil-fuel assets".