Commerce ministry has to take responsibility

Finance minister says about e-commerce fraud

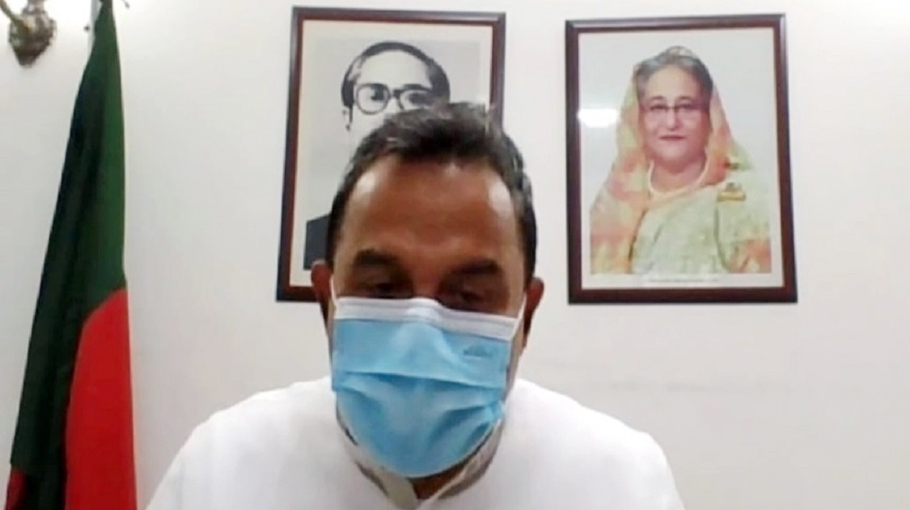

The commerce ministry has to take the primary responsibility of the frauds committed by e-commerce firms as these companies were approved by them, said Finance Minister AHM Mustafa Kamal.

Besides, the ministries concerned, divisions, and agencies also have to take responsibility to deal with the issue, he added.

The finance minister said this on Wednesday while replying to a question during his briefing after the meetings on Cabinet Committee on Economic Affairs (CCEA) and the Cabinet Committee on Government Purchase (CCGP).

He said, “E-commerce firms have to take approval from the Commerce Ministry before establishing any company so the Commerce Ministry has to take the responsibly at primary stage.”

Kamal said that such e-commerce firms often appear in the country and before people and thus tend to cheat with the common people.

Members of the general public were deceived by these groups of firms in various forms on numerous occasions, he said adding that, the government will have to accept the responsibility to this effect.

Finance Minister AHM Mustafa Kamal said that the recent interest rate cut on savings certificates would not affect the small and marginalised investors.

“With this cut in interest rates, the marginalised people and also those who make small investment in savings certificates won't be affected,” he said.

He said usually the savings certificates target the marginalised people and also the pensioners, but in recent times the government has noticed that all are coming to these savings tools due to the comparatively higher interest rates.

If such a trend continues, then the other drivers of the economy will become stagnant, he added.

“Although the interest rates on savings certificates have been slashed, but there was no cut on the rates with investment of up to Taka 15 lakh considering the marginalised section of people. But, still the interest rates of savings certificates are higher than other deposits now prevail in market,” he mentioned

The new rates will not affect the present investment and only be applicable for fresh investments.

Asked whether the government wants to discourage people towards savings tools, Kamal said the government wants to motivate those sections of people to savings tools who actually require it.

The Finance Minister said the recent cut in interest rates has been made considering the rates of deposits in other banks, and also the interest of the marginal investors.

Replying to another question about the progress on the government's move to the decentralisation process, Kamal said that the government wants people to stay where they remain, especially in the rural areas to lessen pressure on the capital.

For this, he said there is necessity to increase manifold the rural infrastructures and civic facilities for which the government has been working tirelessly.

However, the Cabinet Committee on Government Purchase (CCGP) on Wednesday approved a total of 12 proposals worth Tk 4,727.26 crore.

Purchase's proposals included 4 from the Department of Secondary and Higher Education, 3 from the Department of Power, 1 from the Ministry of Industry, 1 from the Ministry of Housing and Public Works, 1 from the Department of Road Transport and Highways, 2 from the Department of Energy and Mineral Resources and 1 from the Ministry of Food, he added.

On the other hand, the Cabinet Committee on Economic Affairs (CCEA) on the same day approved two proposals including a proposal in principle to procure some 11 crore auto disable (AD) syringes and also even more in future as per the requirements from JMI Syringes and Medical Devices Limited to bolster the government's drive to control the spread of COVID-19 pandemic.